Trusted by:

Compliant FATCA & CRS submissions in 4 easy steps

Populate the submission template

Upload the submission template

Download the submission document

Upload your submission document to the relevant tax portal

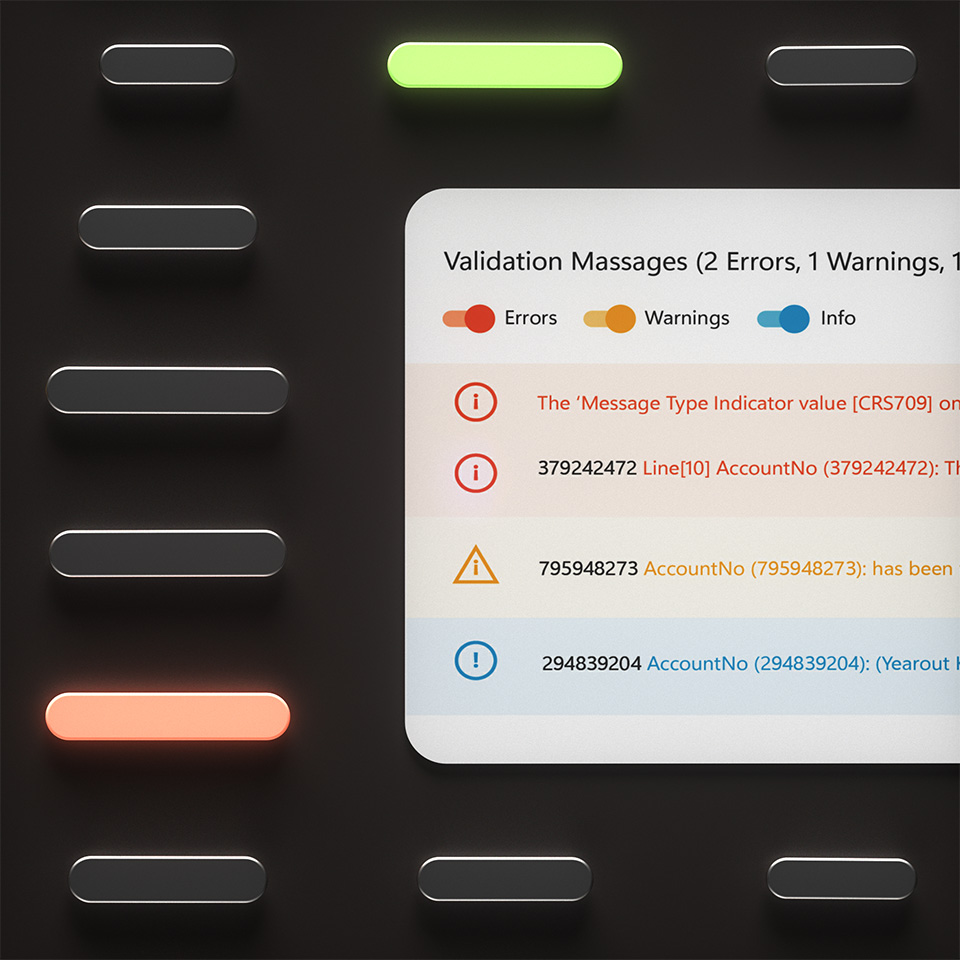

Proactive data quality checks

Minimise errors with TIN validation

Don't leave data quality to chance! One of the main sources of corrections from local or receiving tax authorities are invalid or incorrectly formatted Tax Identification Numbers (TINs).

ReportGenie's powerful TIN validation identifies potentially incorrect country-specific TINs and provides you with warnings and guidance prior to the final submission. Not only can you minimise the likelihood of corrections, but you can incorporate ReportGenie TIN validation as part of your client screening and onboarding process to capture issues and improve the quality of your data at source.

Full control

Quick and easy code-free corrections

ReportGenie has complete support for full and partial corrections and deletions, using the same simple and intuitive template and 4-step process.

Simply start with the original submission and use ReportGenie's template to make the required changes. ReportGenie builds schema compliant submission document with all the correct markers set.

A client-focused partner in software development

"By utilising ReportGenie's TIN validation, we have been able to pre-validate our submissions greatly reducing the likelihood of corrections or resubmissions in the future, resulting in significant time savings. The ease of uploading pre-mapped templates has greatly simplified the process and ReportGenie's jurisdiction-specific XML output is consistently updated to meet the latest requirements, making it a dependable tool for our business needs. We will continue working with Cortex as a client-focused partner."

Kim Hunt

Accounts Manager, Rocq Capital

Consistently stays updated with evolving requirements

"Cortex makes our CRS & FATCA reporting simple. They possess an extensive knowledge of the industry and consistently stay updated with evolving requirements. ReportGenie has proven to be a valuable time and effort-saving tool for us since it facilitates iterative and code-free modifications to ensure our reporting is valid and compliant."

Chris Parott

Director, Sphere Management Limited

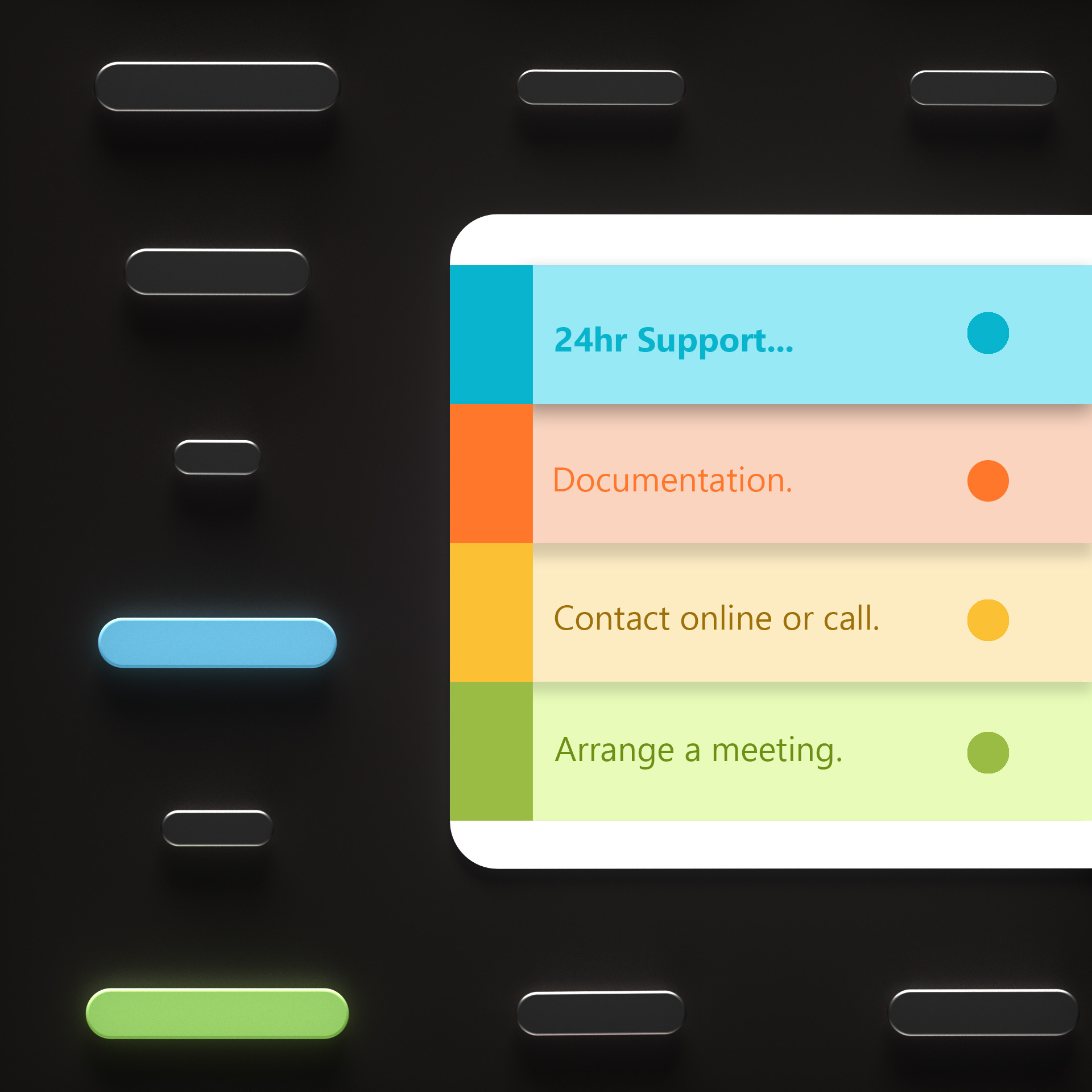

Worry-free reporting

Extra help where you need it

>ReportGenie is designed to be completely self-service. The software is user-friendly and there is no complex onboarding process. But if you need a little extra help, ReportGenie's team are on hand to support you and your organisation through the whole process, including pre-validating the submissions at the tax authority portal where possible.

Data protection is built-in

Keep your data yours

ReportGenie is GDPR-compliant with privacy by design and by default built-in from the ground up. Your sensitive data is never stored other than temporarily in memory solely to create submissions. It is immediately purged after creating the submission.